Bitcoins has a limited supply of 21 million coins that will exist. However, around 88% or 18.5 out of 21 million Bitcoins are available for use.

The Bitcoin halving represents this decrease of the newly issued Bitcoins by half. After the 2020 halving, 50% less Bitcoins will be released for use each day.

The halving could also be described as a 50% decrease of the Bitcoin inflation rate. This is why it is called the halving.

Bitcoins in circulation per day

Currently, 6.25 new bitcoins are released every 10 minutes. These 6.25 new coins are a reward for the Bitcoin miners who secure the network. They often sell some of it to pay their power costs.

Before the first halving, around 50 BTC entered into circulation every 10 minutes. This makes 24x6x50=7200 Bitcoins per day. After the first halving, between 2012 and 2016, the emission rate was cut in half to 3600 new Bitcoins created per day. Then, after the second halving new Bitcoins in circulation again halved to 1800 per day.

Bitcoin halvings and their effect on the price

The halving events usually increase the price of Bitcoin. The last 2 halvings increased the price around 100x and 30x respectively. This is due to the decreased availability of coins and the constant demand.

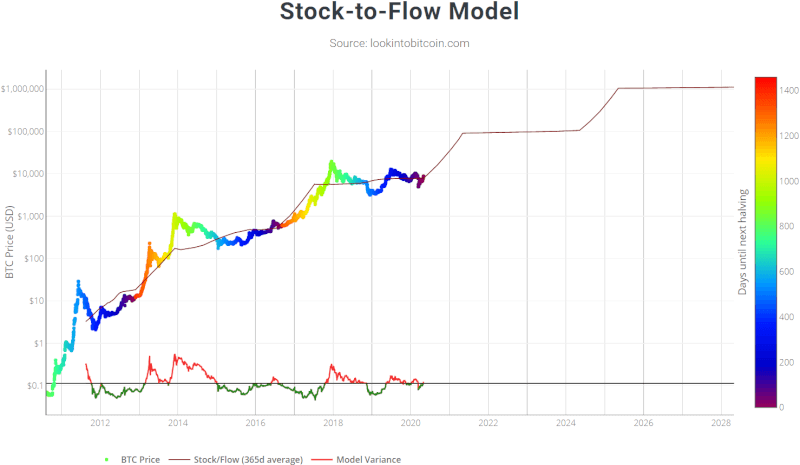

The stock-to-flow model is a Bitcoin price prediction model by PlanB(@100trillionUSD). It explains how the availability of Bitcoins affects the price and it is the most widely accepted one in the Bitcoin community. Furthermore, the stock-to-flow model has been statistically validated multiple times, see here, here, here. They conclude that there is a 95% chance that this model will become true, according to statistics. The stock-to-flow model predicts the Bitcoin price will reach around $90,000 in 2021 and $1 million in 2025. Source: lookintobitcoin.com

The stock-to-flow model predicts the Bitcoin price will reach around $90,000 in 2021 and $1 million in 2025. Source: lookintobitcoin.comFirst Bitcoin halving 2012

During the first halvening the price of Bitcoin was around $12(Nov, 2012) and reached all time high (ATH) of $1,200 (Dec, 2013). An incredible 100 times increase of the price from the start of the halvening to the ATH.

Second Bitcoin halving 2016

On the second halvening the Bitcoin price was $650 (July 2016) and reached an ATH of $19,500 (Dec, 2017). A 30x increase in price. Bitcoin was widely covered by news which helped grew its popularity. As a result, everyone started to talk about it. It seemed that the halvening triggered this increase in price and people started to fear that they’ll miss out (FOMO). Thus, the price increased strongly to $19,500.

Third halving 2020

The 3rd halving is yet to come around 12th of May 2020. The newly released Bitcoins will decrease from 1800 to 900 per day. This will make Bitcoin more and more scarce. This should increase the price if the demand for Bitcoins stays the same. We might see a 10x increase in ATH to around $100,000 per Bitcoin if the same trend goes around.

Future halvings

Bitcoin halvings happen every 4 years:2020, 2024, 2028, 2032 and so on, until 2140 where the last Bitcoin is expected to be mined. There are 32 halvenings scheduled in total. Around, 95% of Bitcoins will be mined until 2025. The rest 5% will be issued by 2140. The maximum Bitcoin supply will be reached and no more Bitcoins will be created.

Summary

To sum up, Bitcoin had 3 halvings and the price increased greatly after each one of them. The first time by 100 times and the 2nd by 30 times. Halvings are a very good predictor for the price of Bitcoin. However, it remains to be seen what will happen on the 3rd one.